Do More What Works

The way you get better as discretionary trader. The goal is not actually to be winning trades because you’re going to get better at what you’re focusing on. I think the winner tend to happen all by themselves. So, if you make your aim to always be avoiding the bad ones and that is your goal ultimately when you’re trading, you’re going to end up refining the framework. You’re going to get better at avoiding the bad traits. So, it is just a question of focus and asking the right question and answering those questions. Then most of your time be avoiding trades rather than trying to get into the market.

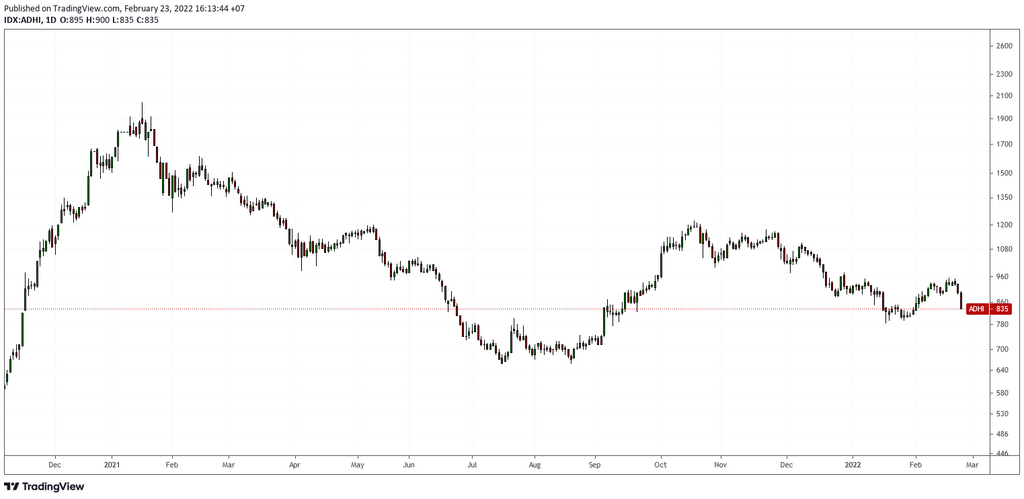

Ritchie when he talk about defensive stocks. “This type of names didn’t end up well with me”.

What easiest change could you have made today, would have had the largest positive impact on your trading or your day. That doesn’t mean just a gainer, it might mean how could I easily avoid some losses. Just really focusing on the easiest change you could make with the largest impact and do that every single day, ruthlessly and relentlessly analyze and detect that. You’re going to accomplish anything. The sky is the limit.

how could I easily avoid some losses? As easy as avoiding trade near earning report.

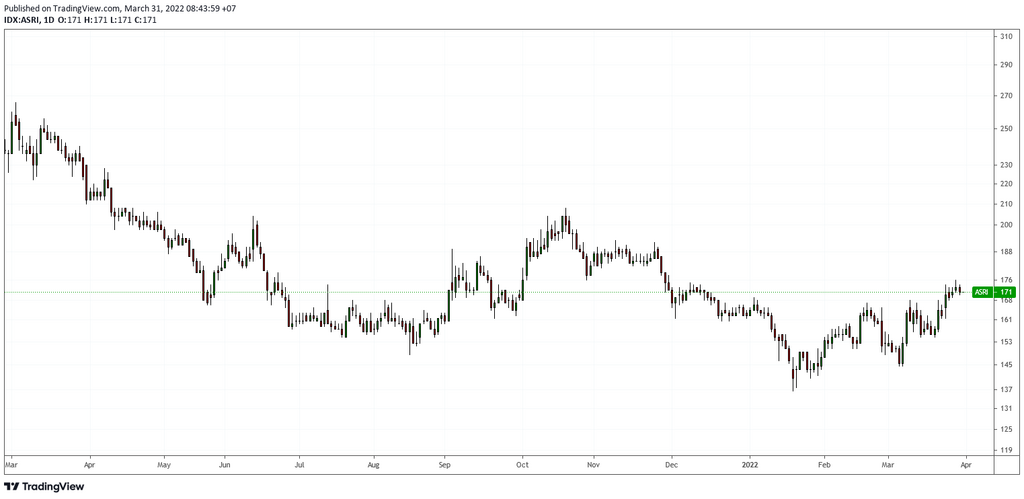

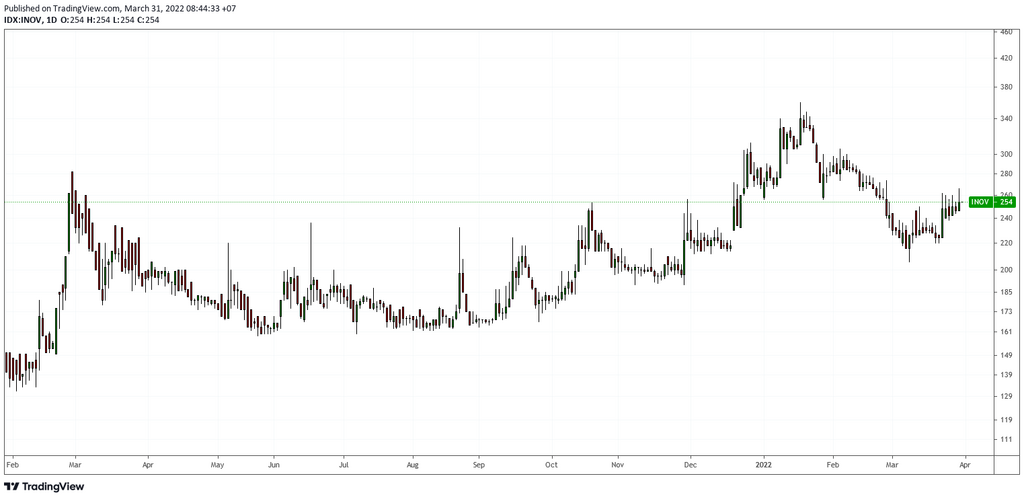

Below is questioning trades on March 31, one month after this post.

CTRA and ASRI were bad choice. Glued to property sector made a flaw in the mind.

REMOVE THE CORR. THINKING. I TRADE WHATEVER SET UP.

No sector. No commodities correlation. No past works.

INOV was right method regardless of the result. It is a low cheat area.