IBD Feb 02, 1998

They are disciplinarians. Like a monk who sticks to his prayer, each remains true to his investing gospel and ignores outside influences.

Keeping the faith has paid off big for the two investment pros. While their investing systems couldn’t differ more, they agree on two points.

- Sticking to a set of proven rules leads to consistent rewards in the stock market. Breaking rules means losses.

- Investors can choose among a variety of sound investing methods. The point is to learn a good system inside and out — and then never deviate from its rules.

“You must be rule-conscious to the point of being robotic,” Minervini said. “To do that, you must strongly believe that what you’re doing will work. If you don’t have an ironclad belief in your methodology, you’re doomed. You’re better off investing in mutual funds.

It’s not about being right or being wrong. This is a probabilities game. If you’re pretty good at this, you should be right 40% or 50%. You can do very well being right 30% — if you let your winner come to fruition and you are really strict about cutting your losses.

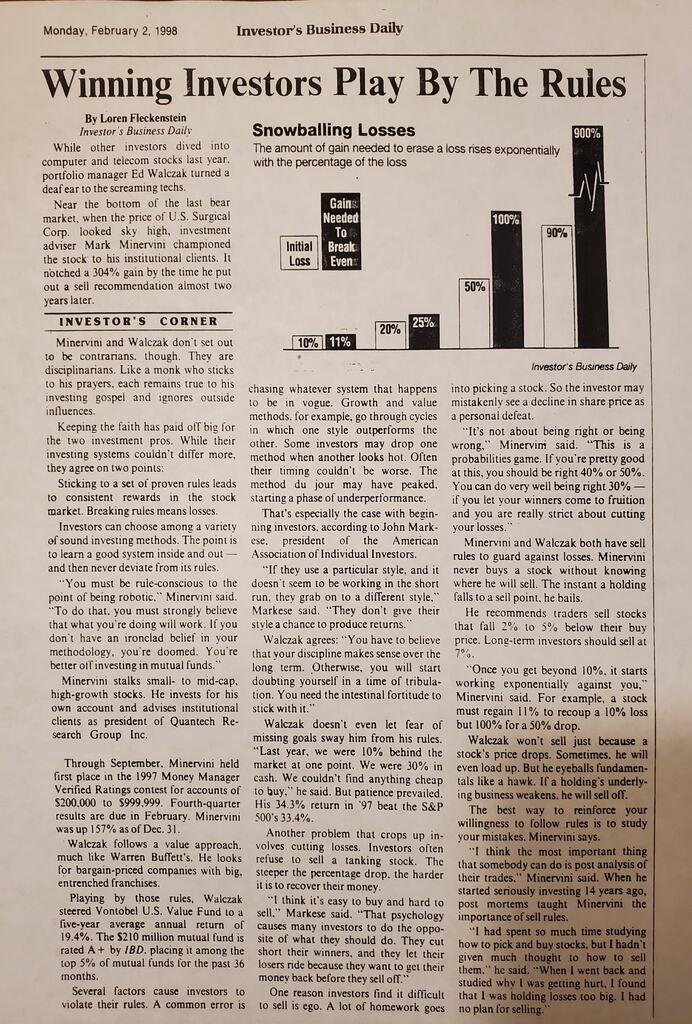

He recommends traders sell stocks that fall 2% to 5% below their buy price. Long-term investors should sell at 7%.

The best way to reinforce your willingness to follow rules is to study your mistakes.