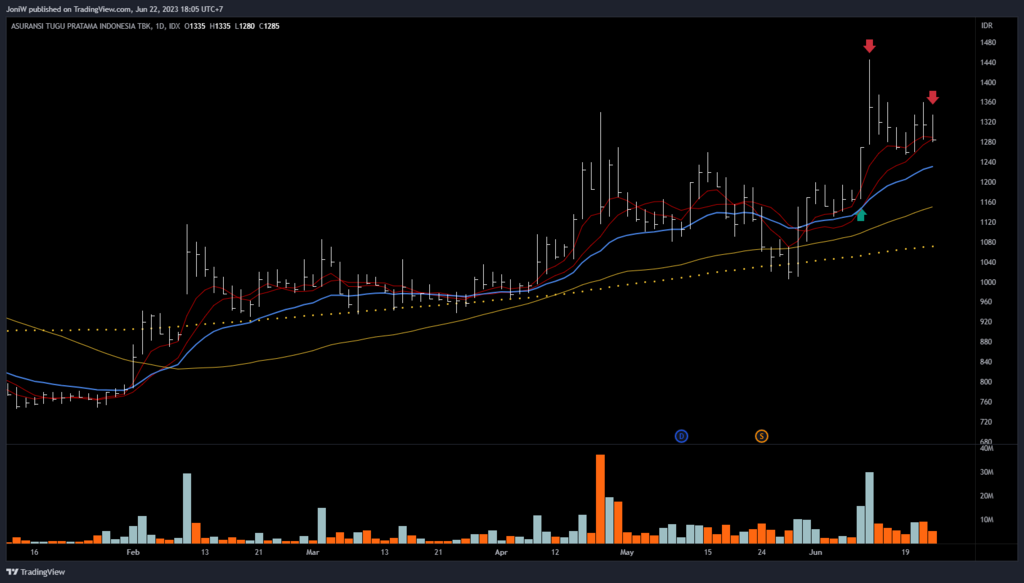

June 2023

Lagu lama ini, but worth to remember. Ada yang naik lurus 14 hari, ada yang butuh 14 hari wedging interwoven up.

Menemukan setup yang uda gigit, itu relatif mudah. I can do it consistently. Tapi untuk melihat reward >10% <50%, mau ga mau perlu beberapa hari. Dan ini bikin selling at profit jadi relatif lebih susah. After buy point, gw ga tau dia bakalan naik lurus atau perlu waiting wedging 14 hari.

kedua tipe roket itu dua-duanya pain.

- yang tegak lurus 14 hari kyk bakalan ending up di selling too soon on strength and missing the good chunk of profit.

- yang stair-step-case 14 hari, bakalan ending up selling too soon on weakness, sehingga bakalan choking up the winner.

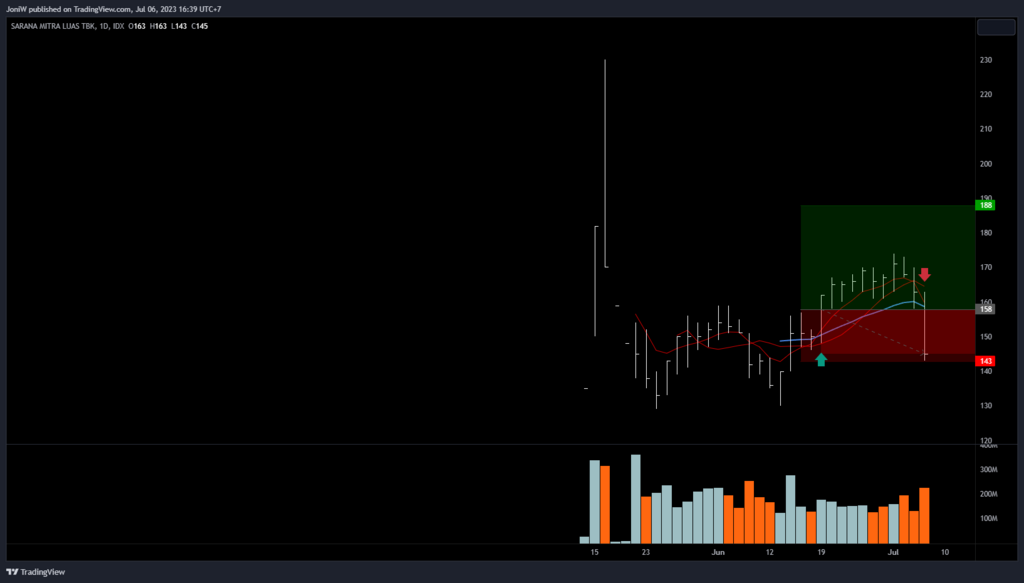

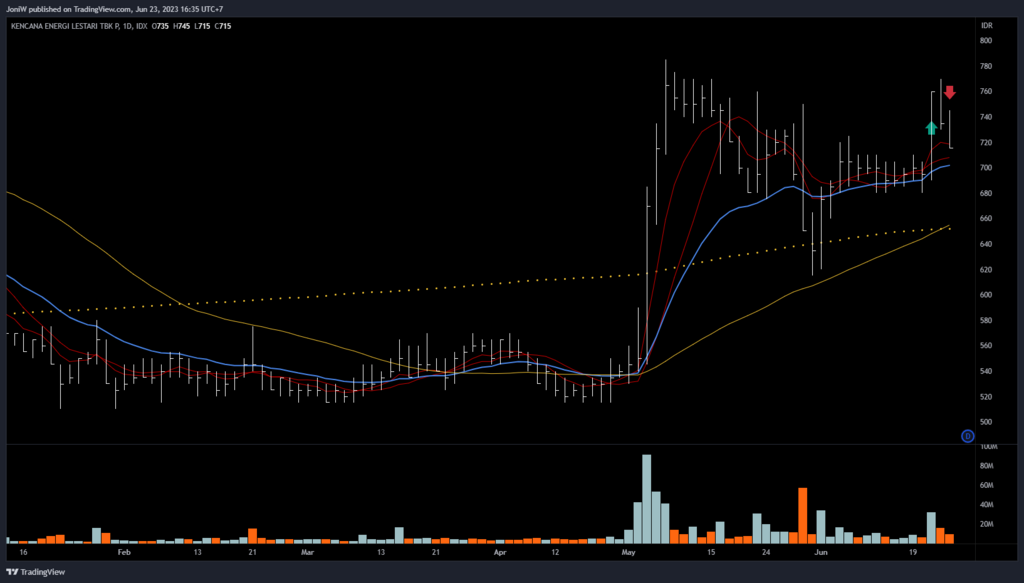

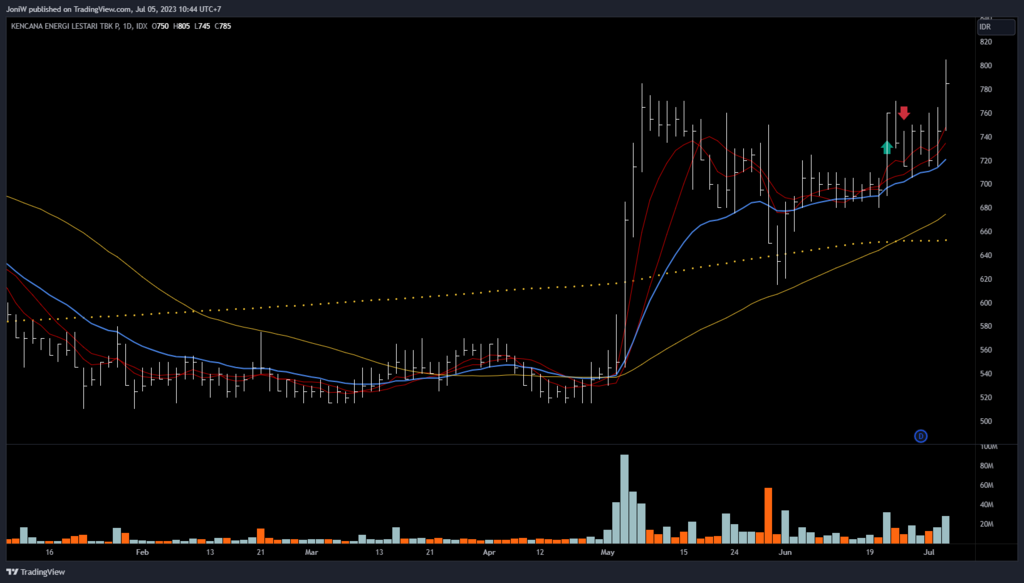

Hijack this space to look at KEEN aftermath.

wmd: The market doesn’t know me exist. Especially with my size. So the line of thinking: “kalau ke breakeven, aku out”. The market doesn’t fucking care. Just trade the fucking technical analysis.

Something he has observed from his dad’s teachings was that the market seems to move in waves of threes, either up or down. Whether it’s three large moves over the span of a month, or three smaller moves within a day, the pattern repeats itself relative to the timeframe. While Ryan doesn’t have historical data to back this observation, he has also noticed this pattern. He refers to it as the market’s rhythm.