March 2022

You will do best if you let stock setups guide you and ignore all the noise from of opinions, economics and the “stories.” For most investors this is difficult. They love to think they know the reasons behind a price move. It’s all BS. The average investor never outsmarts price.

As I Tweeted earlier, I think the indexes like the S&P 500 are running up a bit fast and I would be cautious buying into continued strength without a pullback first. However, for me stock setups have the final say.

Regardless “right” or “wrong”⌗

Are you one of those traders that got

yourself into trouble during the recent downturn, swore you would turn a new

leaf and change your ways, but now that the market is moving up you’re back to

your old ways? Your

problem is not trading, it’s you! Read my mindset book.

As a speculator, the important thing to understand and always keep in mind is… everything looks clear in hindsight, but we can’t trade in hindsight. Risk is managed in real-time. Everything else is just conversation and amateur games that never produce consistent performance.

Kesalahan di Maret 2022:

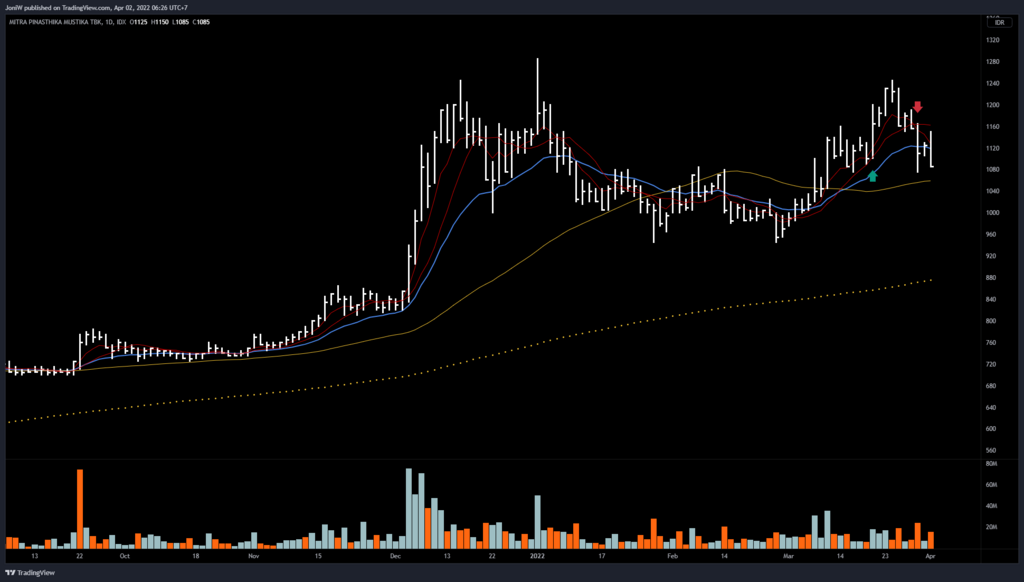

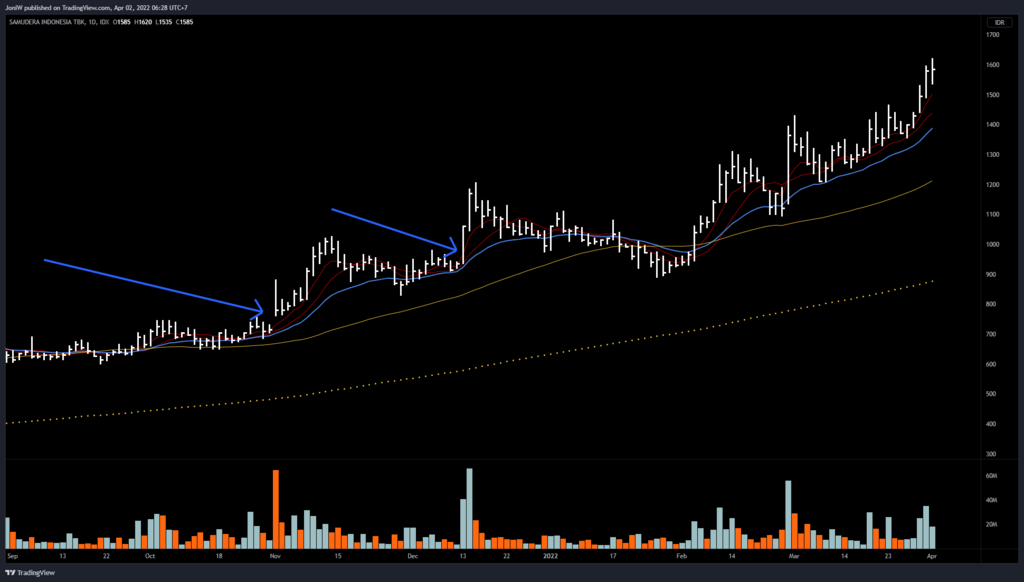

- Di awal Maret, ragu-ragu untuk beli SMDR karena merasa belum all-clear signal to buy. Masih worry.

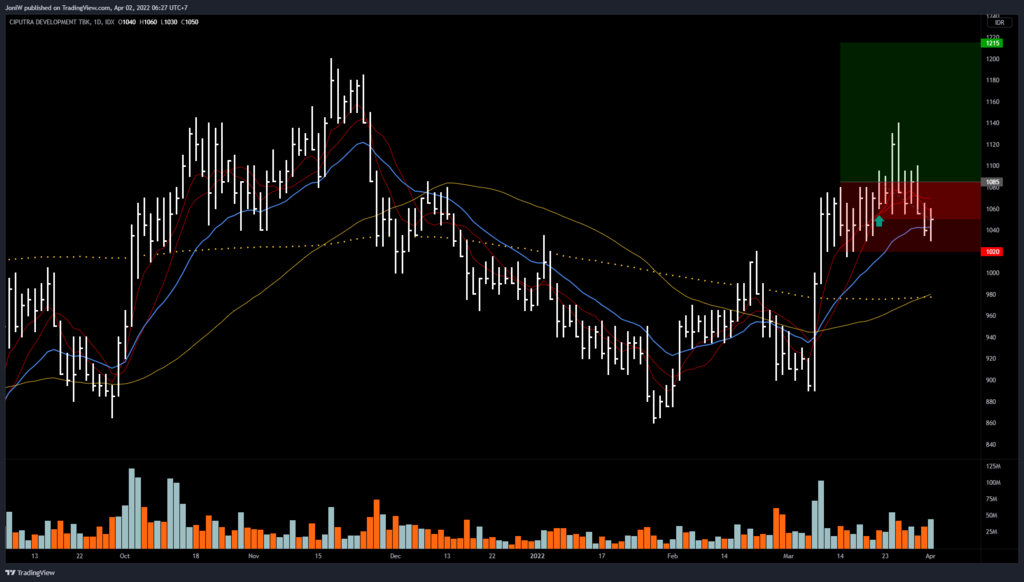

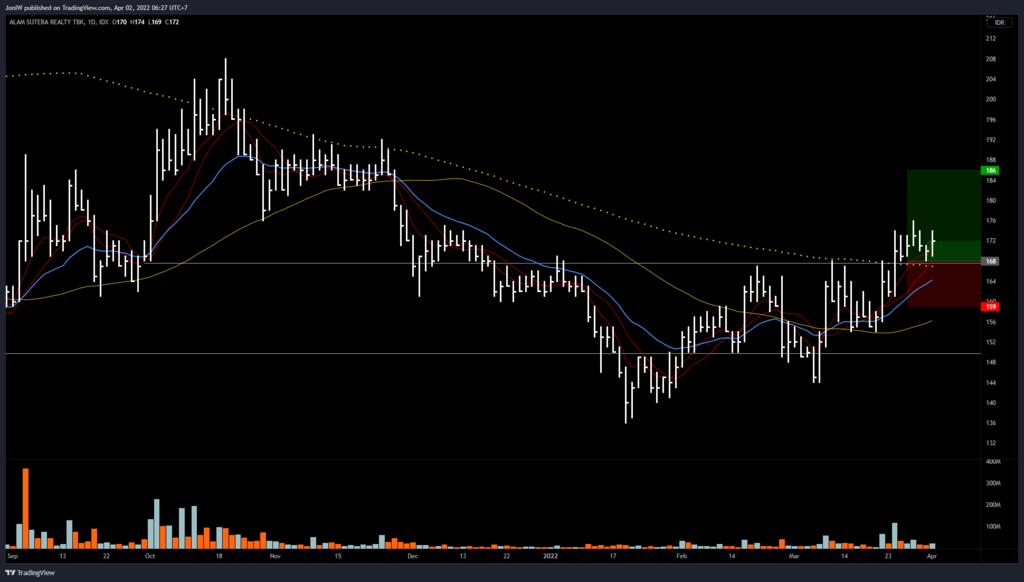

- Setelah good run, jadi sloppy beli grade C+ chart seperti CTRA dan ASRI. Confidence naik sehingga sikat jg yang lower grade. Saat itu mestinya exercise patience karena emang ga ada yang bisa diapa-apain.

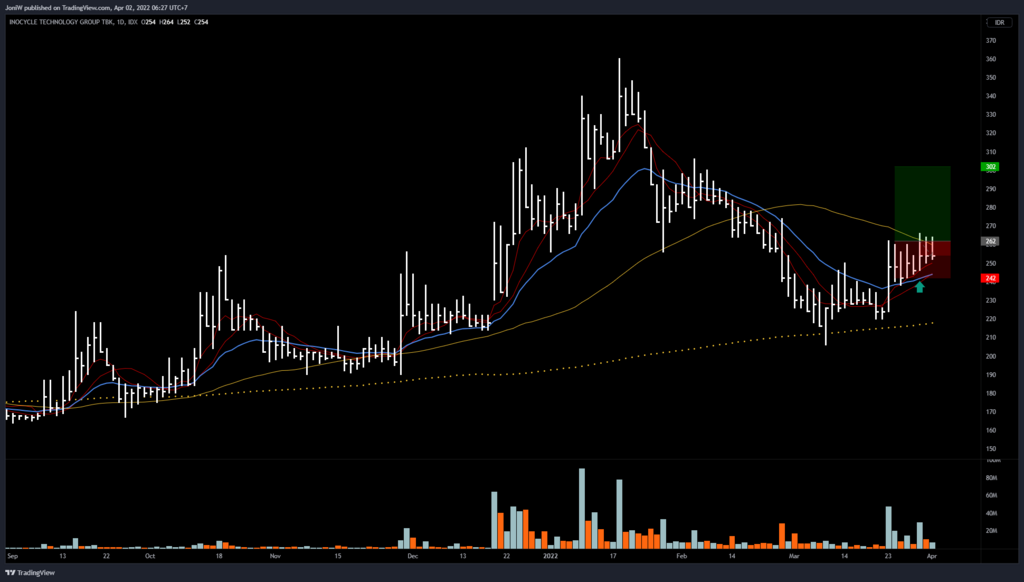

- Yang terakhir, beli TLKM padahal overhead signal uda ditandai di chart. Notes beli ketika break 4680. Jadinya pre-empt di 4640 padahal uda tandai overhead. Eksekusi pre-empt perlu melihat kondisi. Apakah clean cut atau ada overhead jelas.

Yang terakhir untuk hari ini. Liat how flawed is my line of thinking.

“Chartnya oke, tapi susah untuk dibeli”.

Rewired it menjadi, “chartnya oke, aku harus beli. dikit gpp”.

btw, pastikan chartnya indeed bagus.

The final determinant is the stock. The stock has the last word. No emotion of worry at the beginning of the move and not confidence at the last of the move.

“The stock set up, I buy”