May 2022

Trading at a high level requires more than just mastering charts and fundamental analysis. It requires more than mastering position sizing and risk management. It requires mastering yourself.

Minervini Your life is the result of what you think, feel and how you act upon those thoughts and emotions… not the other way around. Get control over your mindset, and you get control over your destiny.

In 2020 – in the midst of a worldwide pandemic – I was about as nervous and unsure as I’ve ever been about buying stocks. But with individuals names meeting my entry criteria, I trusted the stocks not my emotions. 2020 AND 2021 turned out to be two of my best % return years ever.

The Improvement⌗

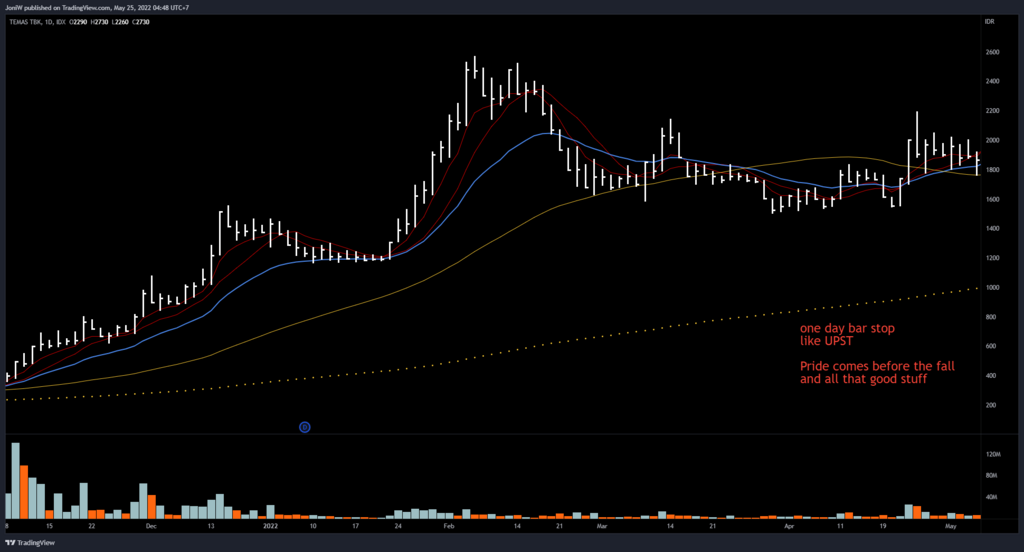

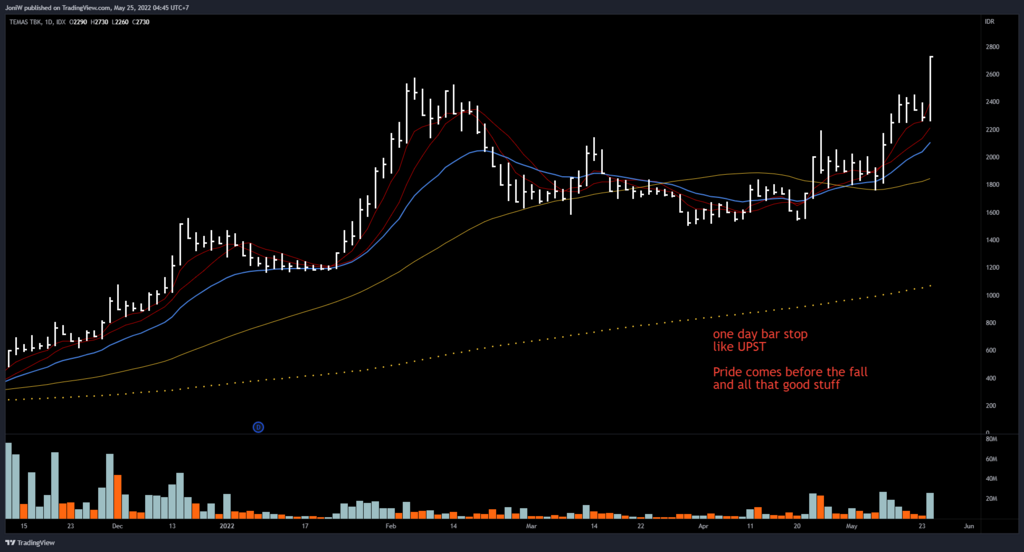

To Think I know where it is going to go. ß This is so dead at ADES pivot. Look at the note below.

The Mantra is:⌗

is the stock setting up?

Ask good question, get good answer.

Follow rules –

fight your arrogance and confidence.

Trading is a game of emotions. It mostly comes down to psychology, and I didn’t get it until very late in the game. I like to pursue things with a forward motion, but I always have that stop-loss under me, so when I get too carried away, I’ve got a safety net. If you have an ego issue, this is not for you. I’ve made every mistake possible, but the reality is: If you don’t have a good handle on who you are and why you do what you do, the market is going to expose your weakness. You don’t have to be a genius to run this methodology. If you’re too smart and you know it, you have this God complex and think you can tell the market where it’s going. That’s just not the way it works. And I’m going to tell you honestly: I think most people don’t ever figure it out.

~ Jim Roppel