I Keep Missing It

Keep Writing Shit This. 0 result.⌗

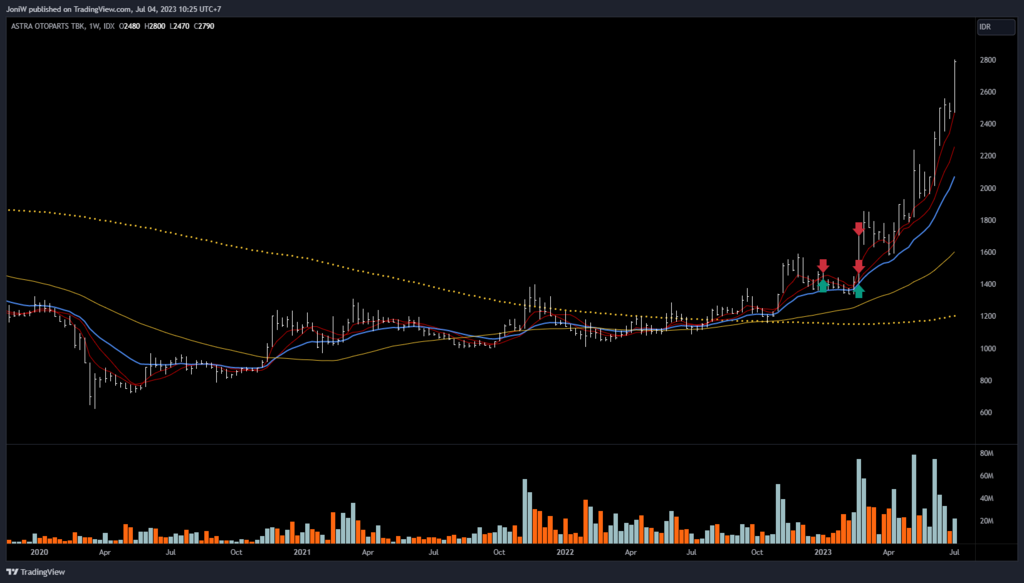

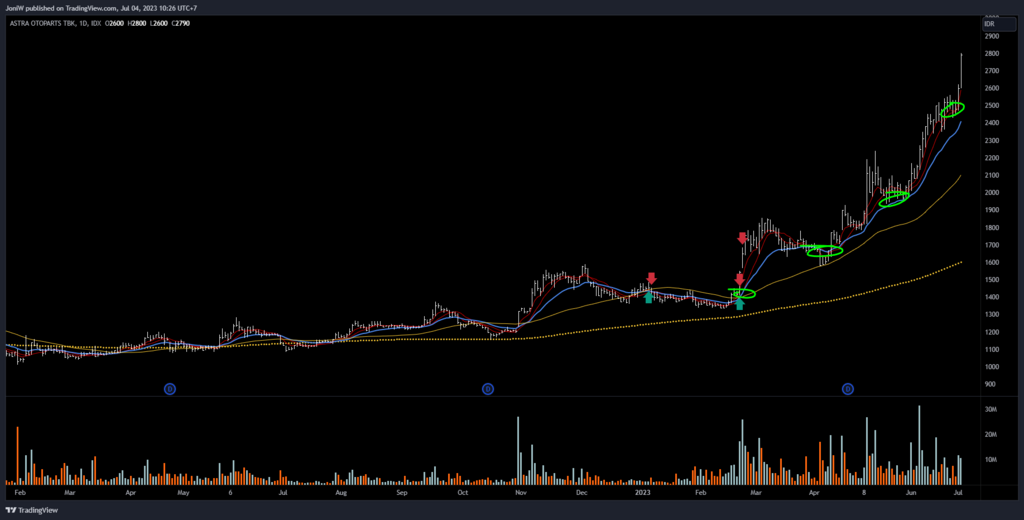

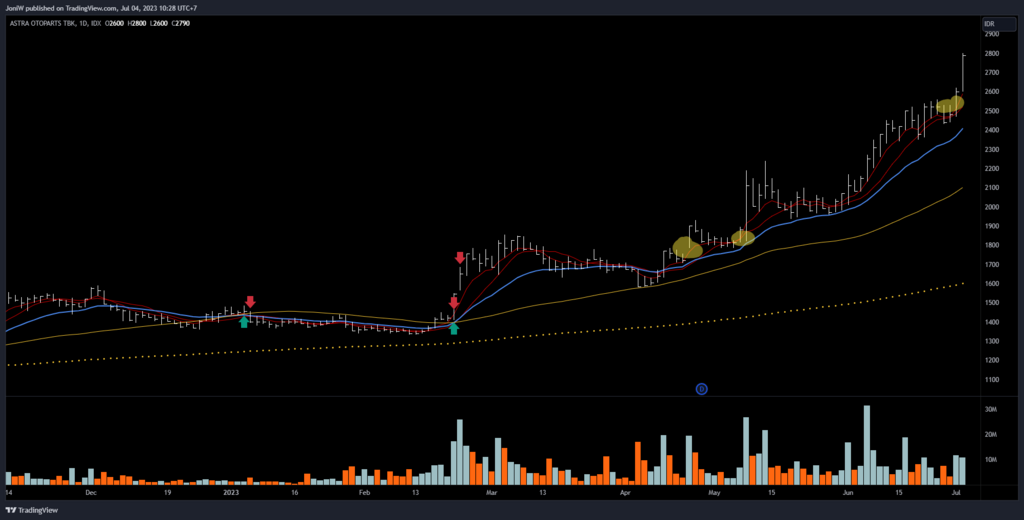

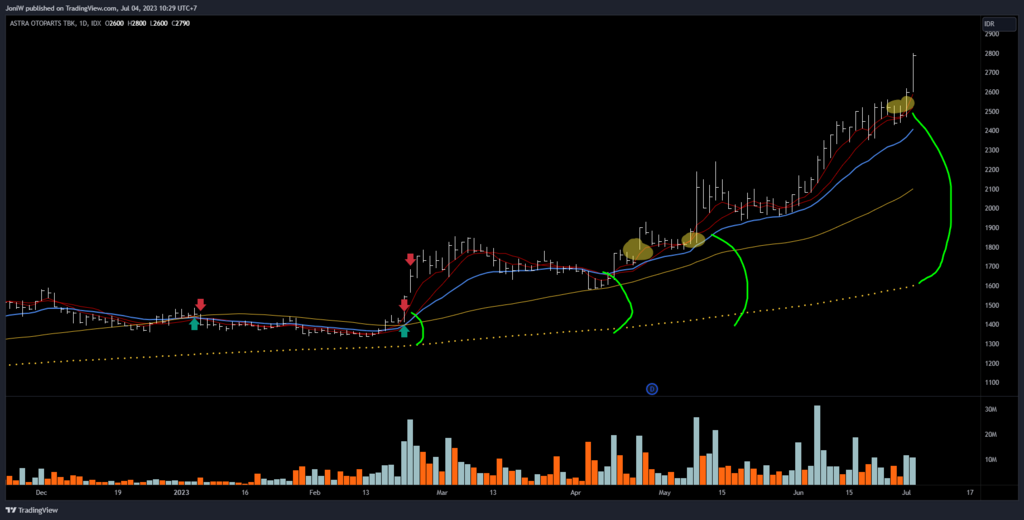

THE SETUP⌗

TRADE THE SETUP⌗

IS IT SETTING UP?⌗

I NEED long enough TIME to scroll through EACH chart. Pelan-pelan nak satu-satu dilihat. liat pattern-nya, liat jarak ke 200dma, 50dma, 20dma, 10 dma. Liat price and time structure pelan-pelan.

“We let the law of large numbers work for us. In a sense, we are trading actuaries.” Larry Hite, Market Wizards.

It is REALLY important that you understand this concept in order to be a successful trader in any asset class over the long run. What happens on the next trade or next series of trades is absolutely meaningless.

I currently am carrying positions based on a couple of set ups:

- A pennant in T Notes

- A H&S top in Robusta Coffee

- A descending triangle in Euribor interest rates

- A rectangle in Canadian Dollars

Please understand me – the results of these trades just do NOT matter. They might be winners, they might be losers. I have no idea which it will be. And, it just does not matter.

The only thing that matters is the bet I make over many trades (i.e. the law of large numbers). My best is this - that if I consistently trade certain patterns and consistently employ techniques so that my losses are small while allowing for profits to grow in a select few trades.

That over many trading events this approach will provide me with a slight edge – and that this slight edge employed with the law of large numbers will yield a trading profit NET over time.

Trading is a game about math – statistics. And statistics is a study related to the law of large numbers. Trusting your next trade is about hope. Hope just does not cut it in trading.

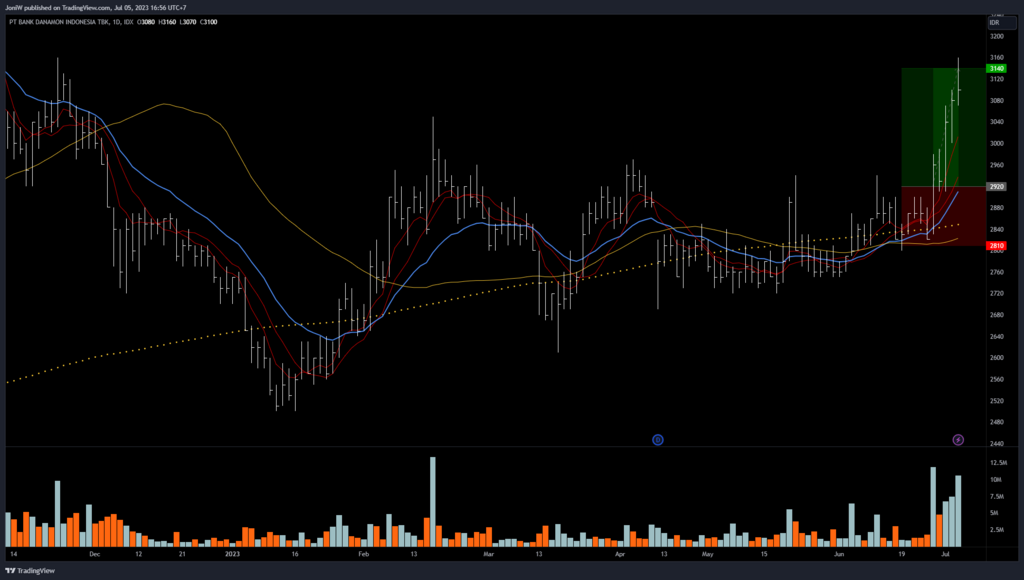

BDMN, Not buy at breakout, then not buy at pb.⌗

I got pressurized at the pb. That’s why I dare it (against it). Line of stupid thinking: “coba aja naik”.

There are always “contradictions” running at the same time. If that weren’t the case, everyone would be millionaires from trading.

ELSA, avoiding div. payout ex. date.⌗