November 2022

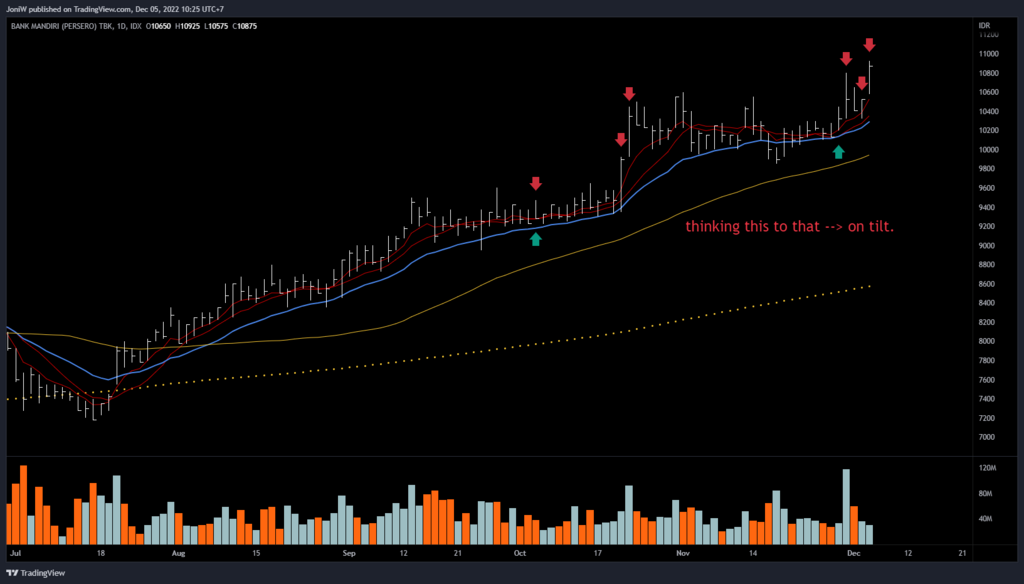

I believe I missed BBRI.⌗

I think it didn’t show up in my scanner due to 20% cut-off from the 52-week-low.

Do I need to change it?

ANSWER: NO. Trade BMRI correctly. Size correctly. Brush up emotion correctly. No hubris. No A then B correlation.

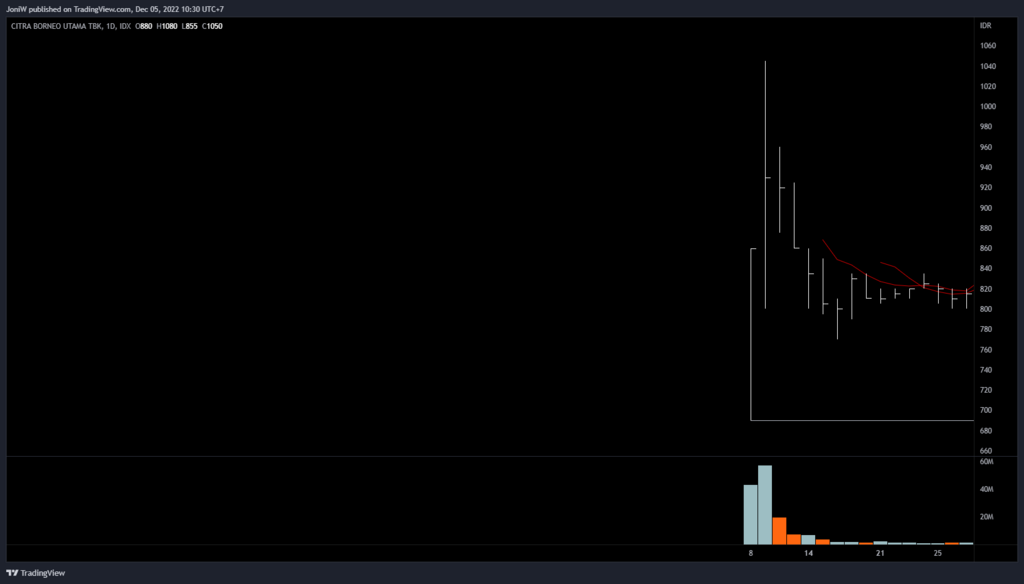

FUCK. THE HOMEWORK THAT I MISSED!!!!!!!⌗

I was arguing with the setups.

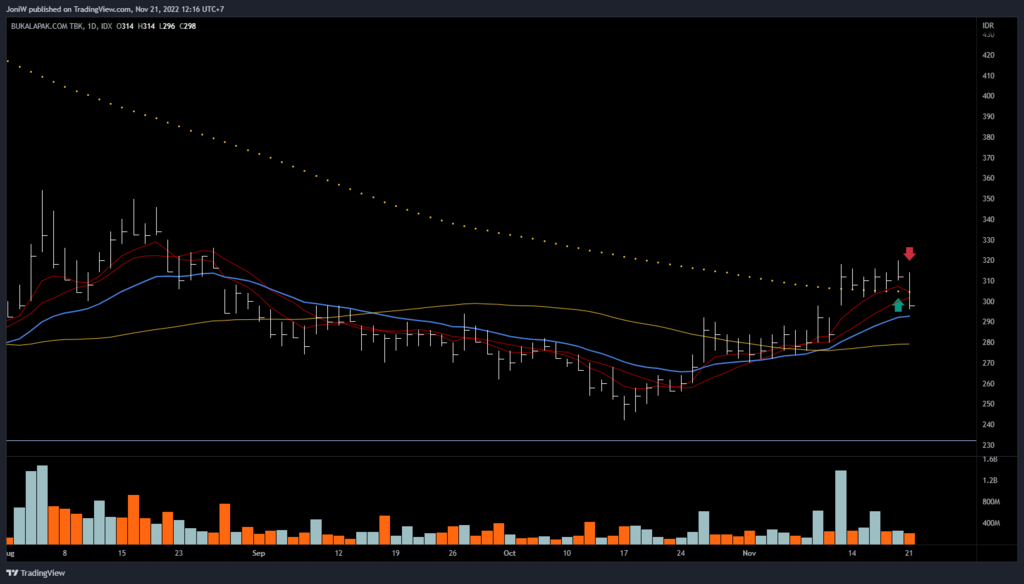

And.. My size was only 200.⌗

At the moment before crossing the line of least resistant, the supply-demand look thin.

Anyway, I can reduce the size.

gw ga tau mau taruh dimana ini. Dari Gemy.

Jadinya titip taruh di post ini deh.

On http://Coursera.org, some ML courses by Andrew Ng are great, including Machine learning specialization and Deep learning specialization. Thanks.

Data science is a general science, not specifically for stock trading. Even after you have completed studing, you are not guaranteed to succeed in finding a good model. It’s not easy, needs lots of experiments.1/3

Now turn to your question:

-

You must first have some ideas/guesses about trading.

-

You figure out a target outcome,like 5% in 1 week etc. You guess some indicators/features may have effects on it.

-

Then you want to infer the relationship between the features and the outcome. This is where data science can play a role.

Data science only helps in step 3.

These are some of the features which I used, fyi:

- (rolling return, rolling average volume, rolling high, rolling low ) over windows (120, 30,10,5,1) days.

- industry identity

- cap size

- some other self-defined features

I remember you asked this question before. It seems you still get puzzled. Indeed I don’t have/use that ratio. I do have measures to control risk, but it’s a different structure which I can’t easily explain in common terminology.

Mostly day trading, a few 2-3 days.

Urutannya:⌗

- AI

- ML

- NN

- DL

ML jadi DL jika neuron diatas 3 layer.

udah, cmn gt aja.

Dari video matlab ini, untuk DL butuh data lebih banyak dan GPU power lebih tinggi.⌗

Liat di detik terakhir ada comparison table.