October 2022

Like the old adage:

- Trust the eyes, not the ears.

- Trust the setup, not the noise.

- Guided by outcome, not outlook.

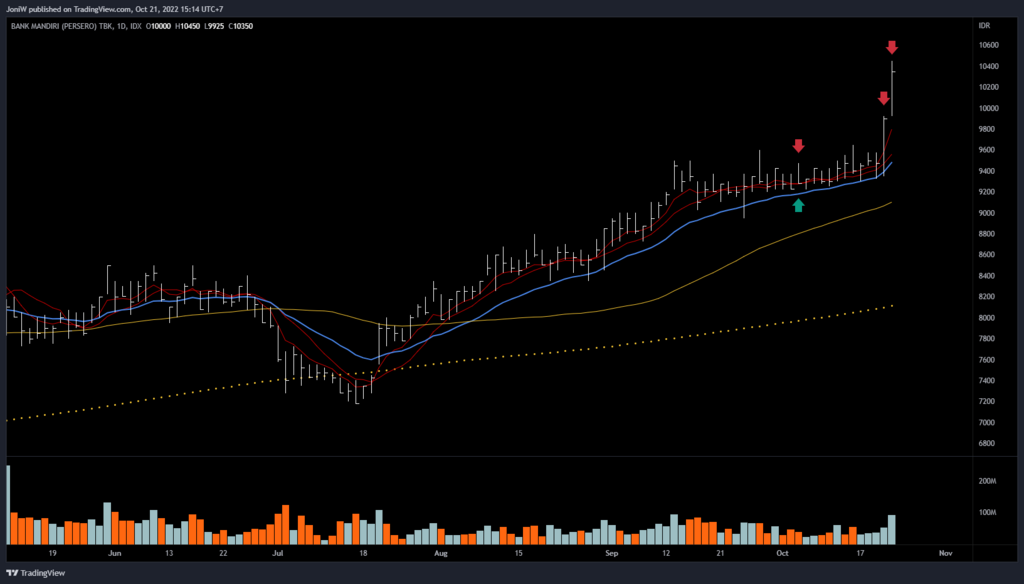

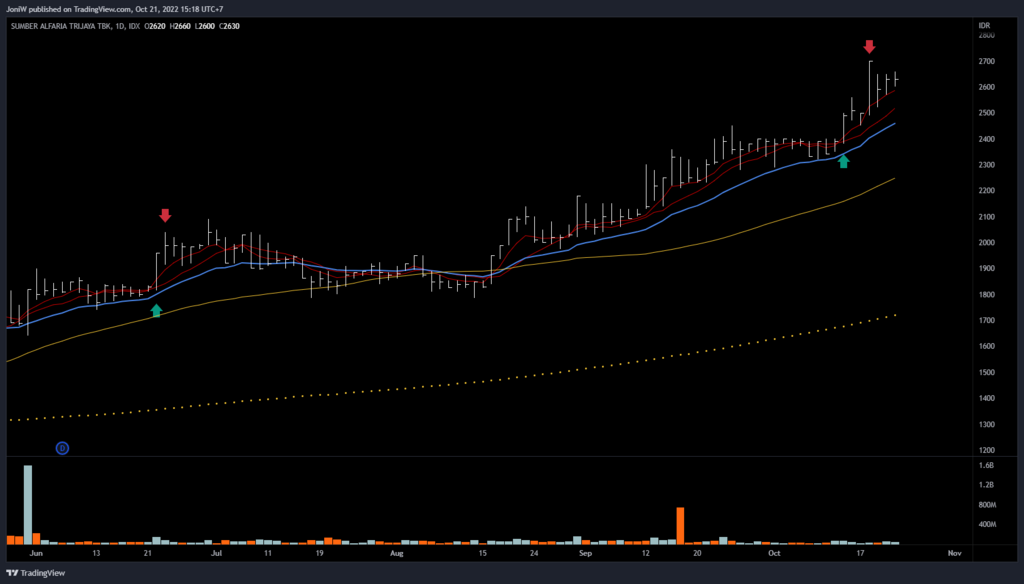

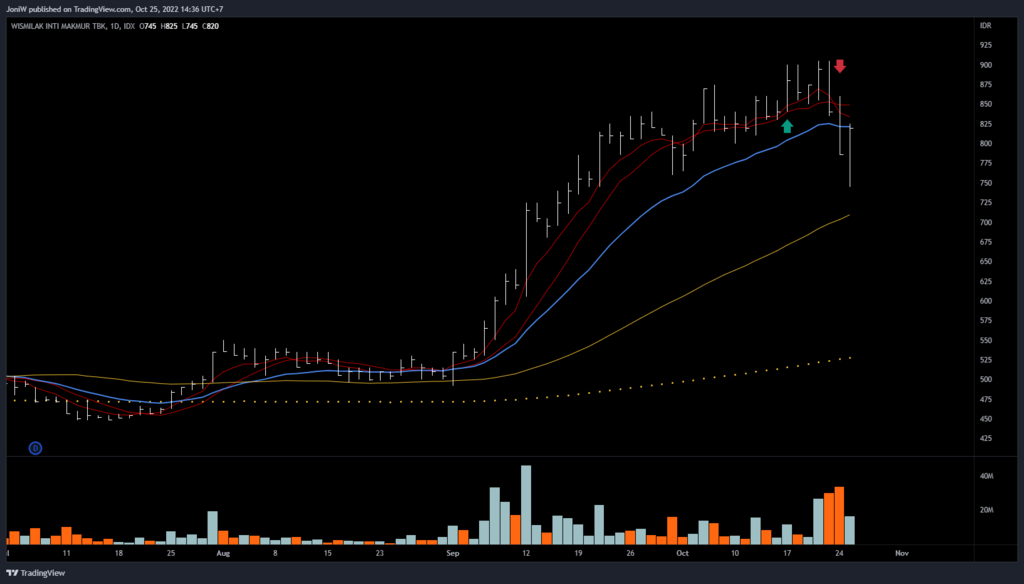

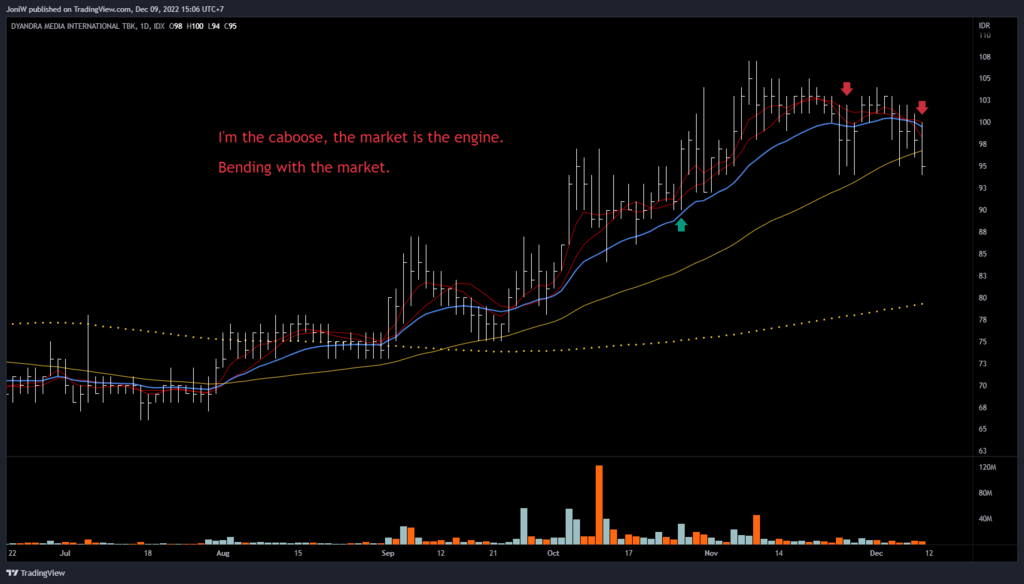

- I am the caboose, get pulled by the train.

salah sizing ini pas beli DYAN.⌗

ikuti aja outcome terakhir, which force to increase size to 1/2R, yakni 714, ga perlu diturunin karena outlook jadi 500.

GUIDED BY OUTCOME, NOT OUTLOOK.

Missed Trades in October!⌗

UNVR kinda hard to catch.

Need to pay attention to the twice shakeout and roundabout pattern. The twice shakeout made it ripen for strong supply-demand situation.

How many times do have a “just this one time” moment? Until you stop having those lapses in

discipline, you can’t call yourself a pro. That’s the difference between a pro and an amateur… consistency.

Everyone wants to be a Market Wizard until it comes time to do Market Wizard stuff. Mike Tyson said “Discipline is doing what you hate to do but doing it like you like it.” That includes exercising “sit out power” when few stocks meet your criteria while the market indexes rally.

Consistency is what separates the amateurs from the pros… the one hit wonders from the timeless legends.

Consistency in making quality decisions. Not in what works every time but over time. It is a contest of discipline.

Discipline is doing what needs to be done regardless of how you feel about it. The difference between pro and amateur is consistency, which is driven by discipline. You and only you are responsible and in control of your own level of discipline.

I, somehow, missed this note. Never arrived at my mailbox.

4 key advantages of swing trading:

-

You have many opportunities per year; consistency.

-

Profits occur quickly; rapid compounding.

-

Losses are relatively small; doesn’t require holding through big drawdowns.

-

Losses are taken quickly; time value preserved.

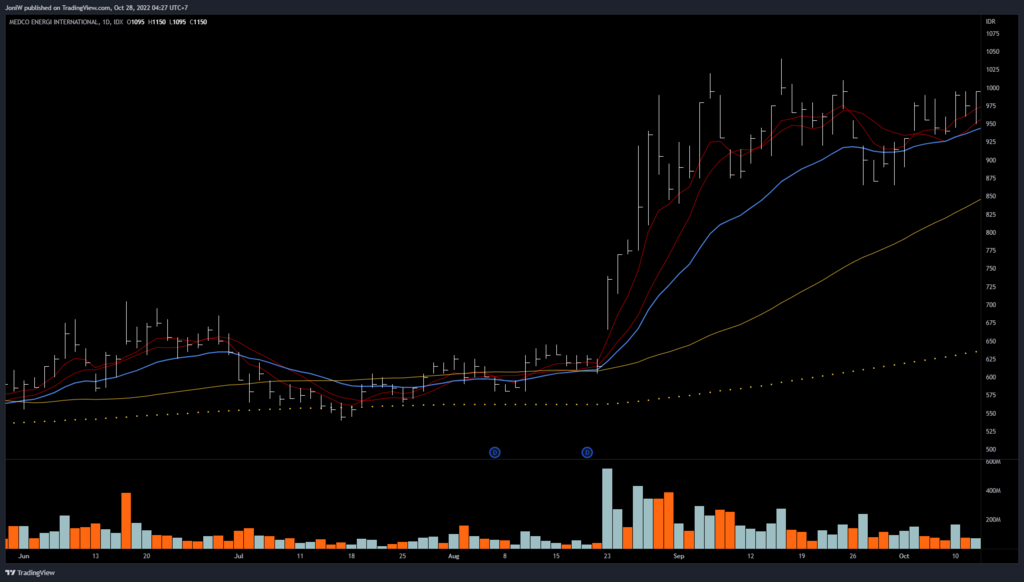

Setup yang “call me” tetapi tidak “as clean as I wish?”⌗

ini XLE. Minervini bought it.⌗