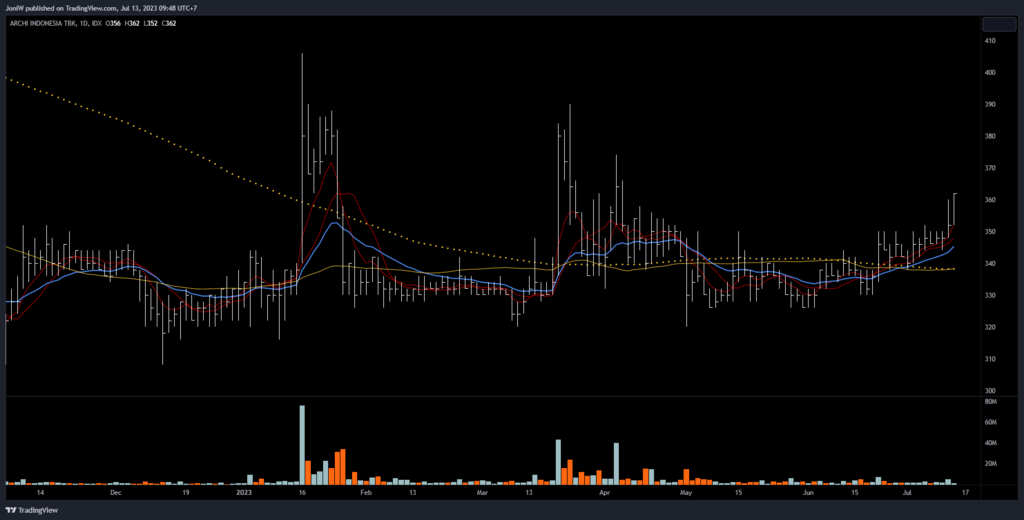

One Year Anniversary Unable to Bend with The Market

-

TA, consistent approach.

-

using horizontal line, looking for consistent action. same with diagonal line. We’re looking for a pattern of behaviour.

-

hunting analogy. learning the behaviour of the market you want to trade. Understand the qualities and characteristics of the instrument I want to trade.

-

example: You count how many swing trades in a year periode. Either it is 10,20, or 30, it doesn’t matter how you count it. What matter is now you know in a month there is one, two or none swing. Then come the problem where traders took 100 trades in a month. why that happen? The trader doesn’t understand about how many rotation happen in a time frame period. If you know only one-two opportunies in a month, you’re going to conserve your ammo. You’ll be a lot more carefull when you are gonna fire the clip.

-

I need to change my behavior to MATCH what the market does.

-

Will told the story about how IF he day trade. On establihing the bias, he use 15-min chart and daily open. one day either close up or down. Will use the daily open to chase the market up or down. I think that is how he establish the bias for the day – then look up for the technical analysis.

-

when you are looking for a trading strategies, what you want to do is the thing with the least number of moving parts. Usually people get to too many moving parts and it gets too complicated and they get confused about exactly what they are supposed to be doing and how they’re going to be managing their risk.

-

Find something that a retard can do, literally. find strategies with only using 10% of brain. Example: Peak performance marathon cannot run twice in a day. This is something I can do forever. I can do it without it ever breaking down.

-

there is literally zero edge in any strategy on ITS OWN. Wmd talk about market harmonics and trading strategies. I need to know when my trading strategies work best. Example: WMD look at BTC chart and saw correction usually between 40%-50%. It means on the bull side, it tend to up 80%-100%. That means, when I’m looking for the short side, I wait until it up 80%-100%. Same with the long side, wait it to correct 40%-50%.

-

Remember, WMD sweet spot is reversal FX swing trading.

-

I’m directional stock equity breakout strategy.

-

WMD talk about muscle memory. You either do day trading or swing trading but NOT BOTH. Because the muscle memory can trip you. Like when you take swing trading signal but end-up treating the trade like a day trading.

-

You can trading breakout strategy or trading mean reversion strategy. You cannot do both. You notice there is muscle memory because both of them are opposing strategies.

-

There is always regret involved.

-

Maintain objectivity. Look at everything with a fresh eye. Becareful with the slippery rope, like attaching some ideas with the last trade.

-

MM: The best trader are the ones who recognize mistakes, dispassionately cut their losses and move on, preserving capital for the next opportunity.

-

WMD: Stanley Druckenmiller took 6-months time-off in Morocco.

-

WMD talk about not EXACTING the idea, but about having the general idea. Let’s say BTC in its normal days, move between 3-5%, if someone said it is 5-7%, I don’t fucking care. It’s about having the idea, not the exact number. Then you can appreciate the information is giving you.

-

Say like BTC normal day versus outlier days is 13 days in 15 days if you’re pessimist or 10 days in 15 days if you’re optimist. Then when all of sudden your trades are green, then you know it is in outlier days, which usually last 2-5 days.

-

Wmd then continue about the regret in trading. First you study the market then you will adapt your expectations based on the study you did rather than expecting the market to change to meet MY expectation.

-

Not based on luck but doing it deliberately.

-

Confirmation bias: People looking at the lottery winner but not how many people played it.

-

Looking at the market environment to decide whether the signal is a good signal or not. Always think about the market environment first, then see whether this signal make sense or not.

-

I need consistency in all of these: consistency in chart that you’re looking at, consistency in the technique you’re applying, consistency in your execution, consistency in your risk money. You need all of this to get consistency result.

-

If you tried 50 different market enviroment, etc etc. Good luck with that. I have found one.

-

People want to feel safe. So they look at the chart that is not moving because it makes them feel safe and then they take a trade and they lose. I have on word for them. Pussies.

Shout out to my mentors

Here are 3 gold nuggets I picked up from them..

-

Jimmy Rogers. Gold was trading under $1200, his long term forecast is higher. Asked if he bought any he say’s he’s never been good with timing, “So i bought a little bit, and if it dips i’ll buy a little bit more” You can have wide entry’s and still make money

-

Warren Buffet. The year is 2016.. Apple stock is trading under $100 and silver boi is buying because he says for reasons x, y & z, its worth at least $200 Don’t take the trade if you don’t know where price is going and why it has to go there

-

Paul Tudor Jones. In the Trader 1987 documentary, when he takes the trade, he is betting on the direction of the day, in at the open, out at the close You can do this with any time frame, any candle. Trading is a binary option Red socks are not lucky

What they all have in common is that they are more concerned about direction and future valuation then the entry

The PTJ documentary was one the biggest single influences in me developing my trading process, especially the way I think about flow.